36+ how to get your name off a mortgage

There is another process called novation through which the mortgage can be transferred in your husbands name but lenders prefer refinance over novation. Web Once the lender company goes through your financial information and credit score and find them satisfactory you need to sign a mortgage novation.

257 Dusty Road Lopez Island Wa 98261 Compass

If youre trying to get equity out of the home to pay out the other spouses share of the house a cash-out refinance can be the best course of action says divorce mortgage consultant Todd Huettner.

. Web If your partner has sufficient credit on his flexible mortgage to be able to pay off the mortgage on your flat he wouldnt have had to make an application to his lender to spend the money. A refinance would pay off the existing loan and create a new loan in just your ex-spouses name. Contact your tax collector.

Web Heres a look at seven different ways to get out of a mortgage. I wouldnt be able to tell you what impact this might have on your FICO score but the loan as said above will continue to report positively for you. Buy out a spouse.

Web The only way you can remove your name from a mortgage is to pay off the mortgage in full. Web Your husband would have to apply for a new mortgage using his income and credit alone. Investigate a Loan Assumption Probably the easiest way to get one persons name off a mortgage is by qualifying for a loan.

This is often the best way to remove a name from a mortgage and in some cases it may be the only way. For example fax the lender a copy of your divorce settlement or a letter from the doctor describing your wifes condition. Ask Your Lender Start by asking your current lender about changing the loan.

The lender may require two years of on-time. Understandably they hesitate to let anyone off the hook. Web Call your loan servicer to ask whether you can take a name off the mortgage through these methods.

Explain the details of your situation and provide the lender with documents to support your explanation. Web You should get it automatically within 20 days of paying off your loan. If your local tax collector has been sending.

Web To remove your name from a mortgage the original borrower will need to refinance the loan in only their name which will require paying closing costs and meeting the lenders credit and debt-to-income ratio requirements. Web When a loan allows cosigner release the lender sets conditions up front. This can be done by arranging a new mortgage in someone elses name as in the sale of a house or by any other person who has co-signed your mortgage with you to negotiate a new mortgage in their own name paying off the current mortgage with the new funds.

The person seeking loan modification should submit an application with documents reflecting their financial situation. From the lenders point of view multiple borrowers are multiple people to hit up for payments. Web Depending on the situation there are a few ways to remove a name from a mortgage but refinancing is the most popular.

If the conditions are met the lender will remove the cosigner from the loan. Then when the mortgage is refinanced your name will be off. Web To get one name off the mortgage you must deal directly with the lender.

Web There are a few ways to take someones name off a loan. Do this in front of the lender and have. Expect the process to take some time and a great deal of paperwork but if you can follow each step one-by-one youll soon be able to put the loan behind you.

Lenders may be willing to refinance your mortgage under a single homeowner. Feel free to ask if you have further queries. 2 Apply for loan modification.

Web in order to remove your name from the mortgage your ex-husband will have to refinance the mortgage. If not contact your loan servicer. If youre able to persuade your ex-spouse to refinance the loan into just his or her name then youve accomplished your goal.

Web There are several ways get your name off a mortgage loan. For conventional loans these possibilities are long shots. Web Refinancing doesnt remove the co-signers name from the deed so you must file a quitclaim deed where the co-signer gives up all rights to the property.

This is a new contract which removes someone from the mortgage loan and he has to sign a quitclaim deed which transfers the property to the remaining borrowers. Web For the mathematically inclined heres a formula to help you calculate mortgage payments manually. Web If the person staying on the mortgage qualifies financially the Loan Modification Agreement can be written to remove your name from the mortgage.

Refinancing the home is one way to approach a divorce house buyout. Equation for mortgage payments M P r 1 r n 1 r n - 1 This formula can help you. Sell Your House One of the best and fastest ways to get out of a mortgage is to sell the property and use the proceeds.

Web Call your mortgage company to ask if you can remove your wifes name.

4 Ways To Remove A Name From A Mortgage Without Refinancing

7 9vv5 Xznzcxm

How Can You Remove Your Name From A Mortgage Youtube

1218 36th Ave N Saint Cloud Mn 56303 Realtor Com

How To Remove A Name From A Mortgage Youtube

4 Ways To Remove A Name From A Mortgage Without Refinancing

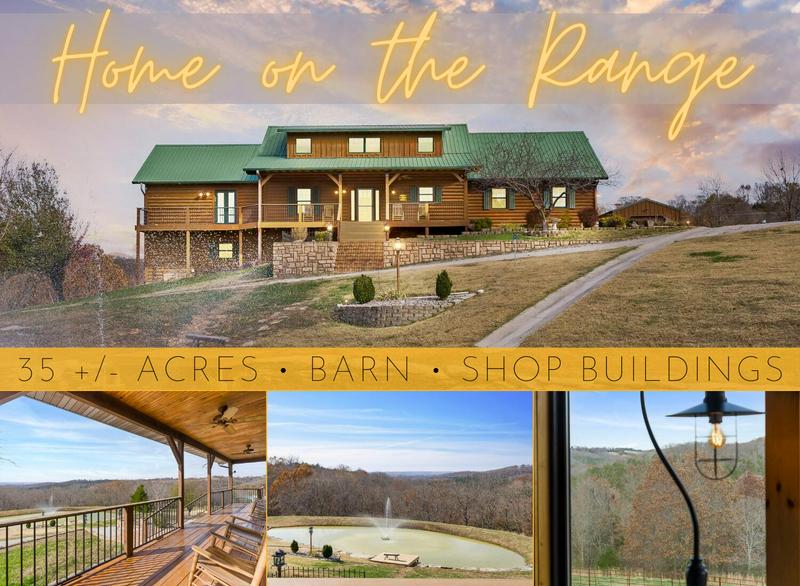

1006 State Highway Zz Niangua Mo 65713 Mls 60231260 Zillow

2323 40th Ave S Saint Cloud Mn 56301 Realtor Com

54 Sedgley Road Greene Me Western Maine Homes Land Vacation Rentals

How To Remove A Name From A Joint Mortgage

681 Hardin Hills Dr Galena Mo 65656 For Sale Mls 60231767 Re Max

Homes Land Of The Smokies Vol 36 Issue 11 By Homes Land Of Tennessee Issuu

214 Palm Springs Ave Cheyenne Wy 82009 Zillow

Mortgage Broker In Rowville Wantirna Mulgrave Mortgage Choice

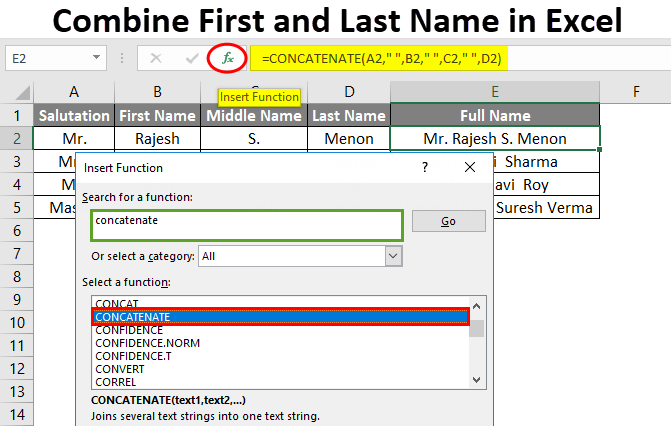

Combine First And Last Name In Excel With Excel Template

Tom Jessop Tj Nichelender Twitter

How To Find The History Of A House Online And Offline