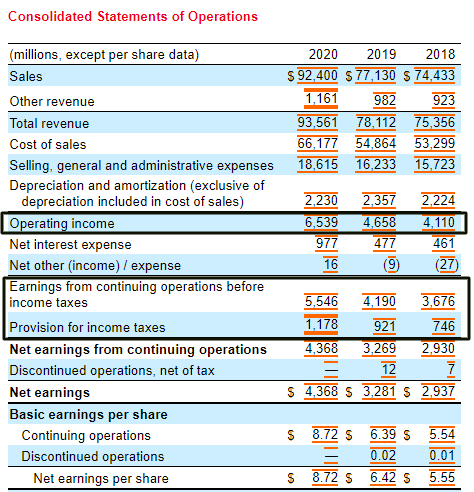

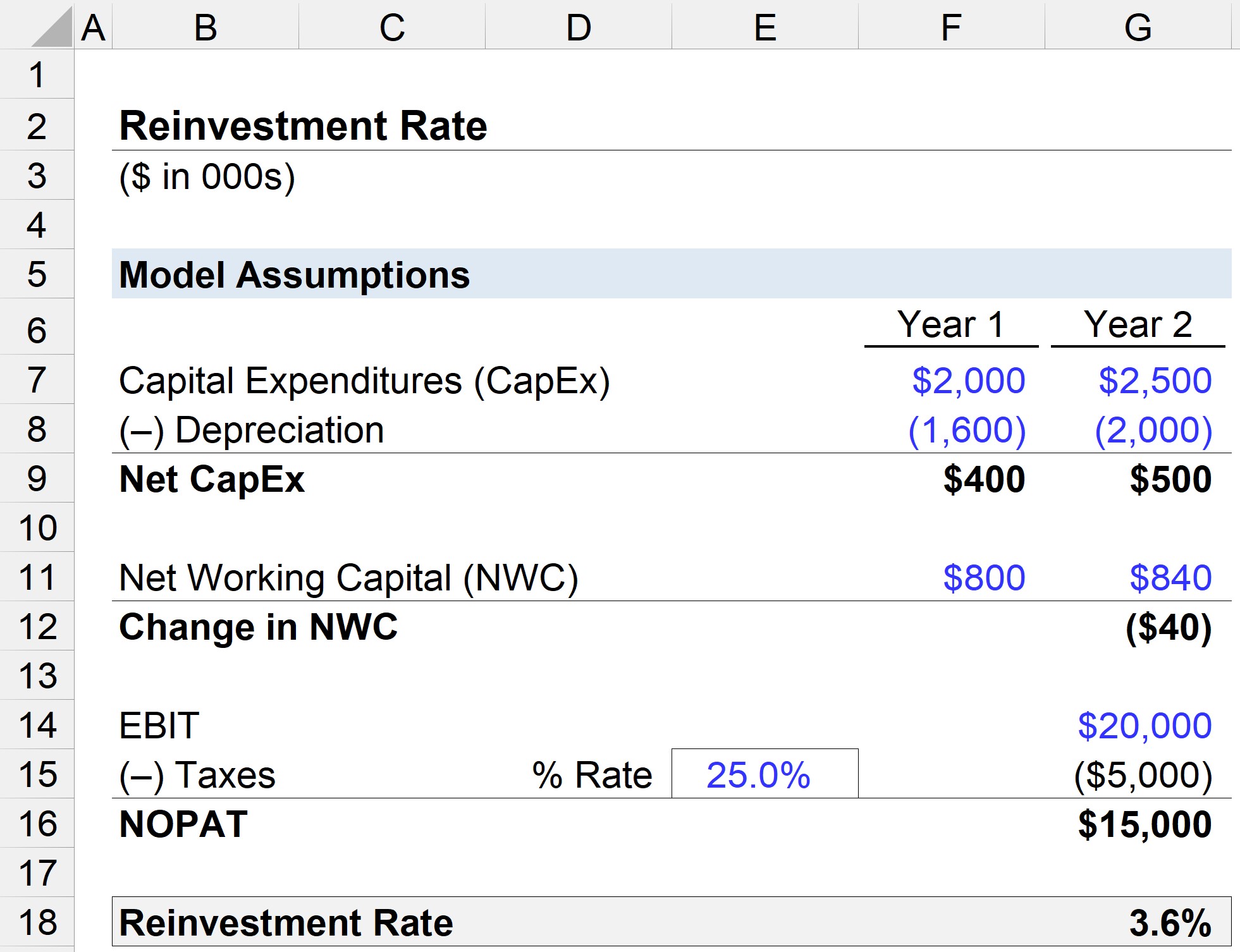

Reinvestment rate formula

The equation for the cash reinvestment ratio is as follows. A casinos player reinvestment rate on a monthly basis.

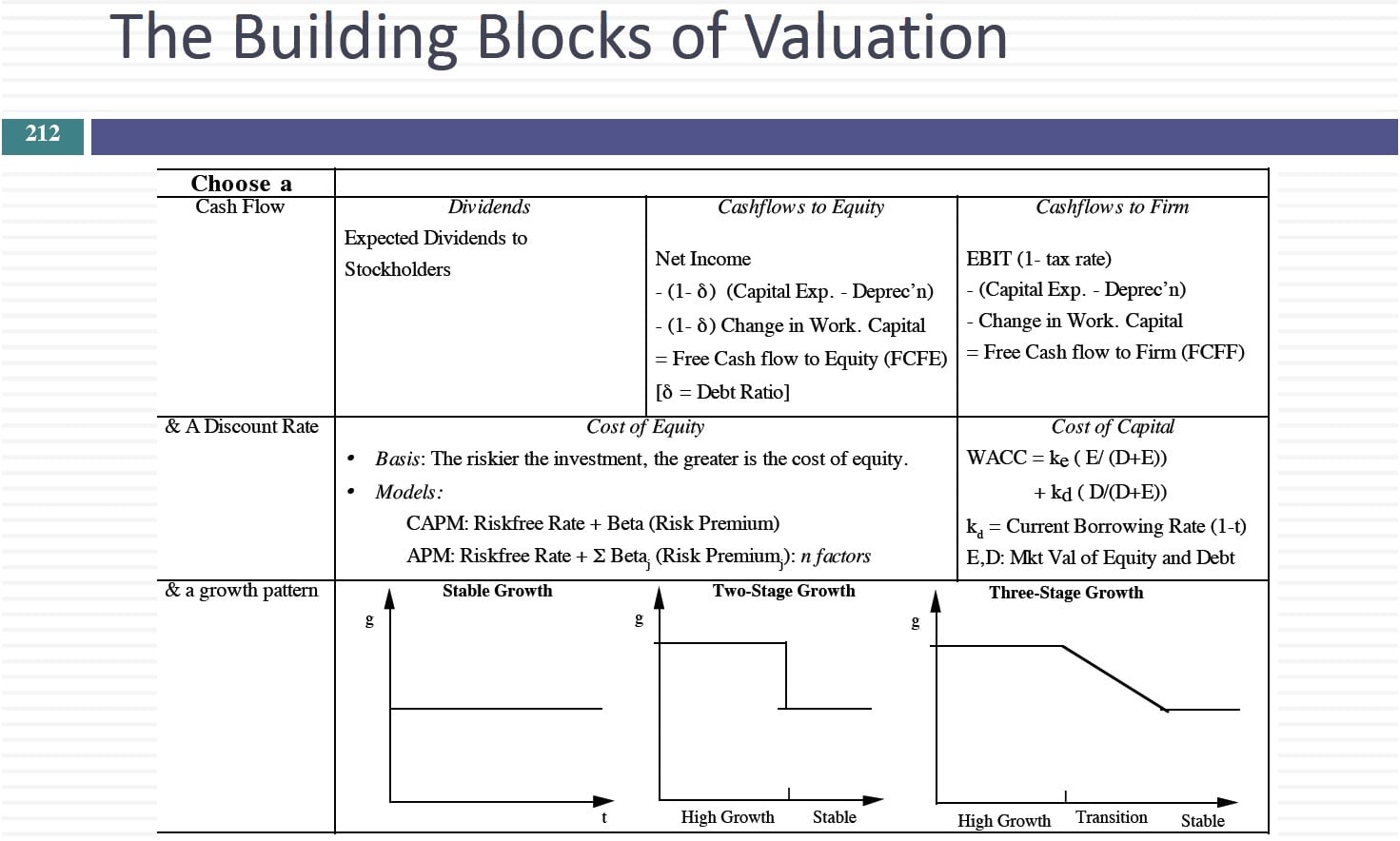

The Fundamental Determinants Of Growth

The financial management rate-of-return formula still assumes Ryan will reinvest the entire 300 per month.

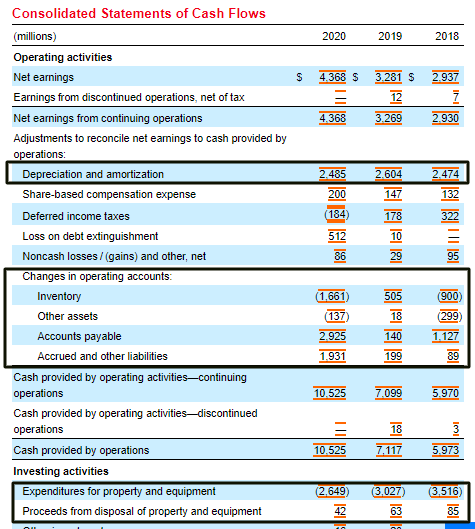

. Then subtract non-cash sales 30000 and dividends. Where FVCF Future cost of the positive cash flows after deducting the reinvestment rate or cost of capital. The formula for the cash reinvestment ratio requires you to summarize all cash flows for the period deduct dividends paid and divide the result into the incremental increase.

Here this step helps you to choose how much money you want to invest in a stock. The reinvestment rate is often measured using the most recent financial statements for the firm. Future dollar value 100 x 10430.

The formula assumes a reinvestment rate of 15 percent which is highly unlikely. To calculate the adjusted cash flow we can add non-cash expenses 168000 and the net income 6023000. Although this is a good place to start it is not necessarily the best estimate of the future.

Experimentation to Find the Right Reinvestment Rate Once the data has been collected and a. The formula assumes a reinvestment rate of 15 percent which is. Since there is no capital gainloss the bonds YTM will also be 8.

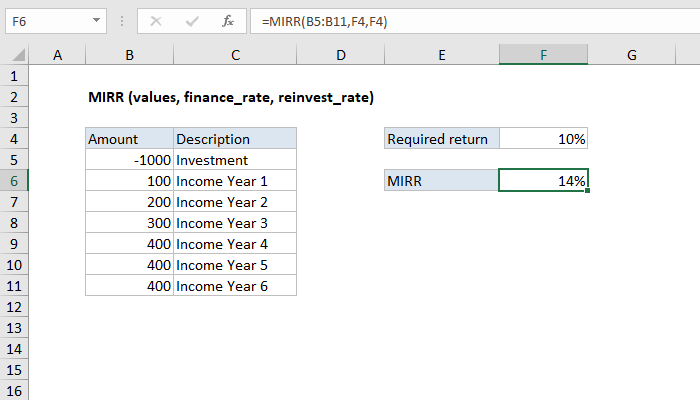

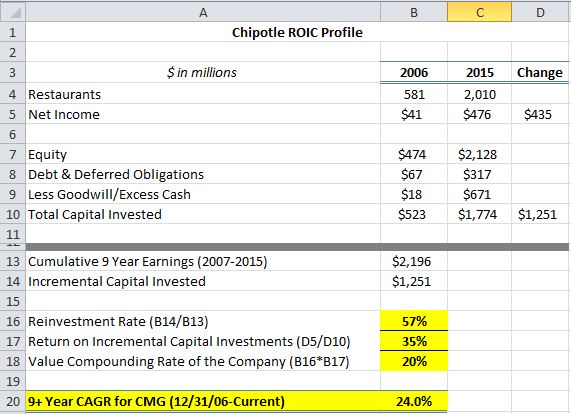

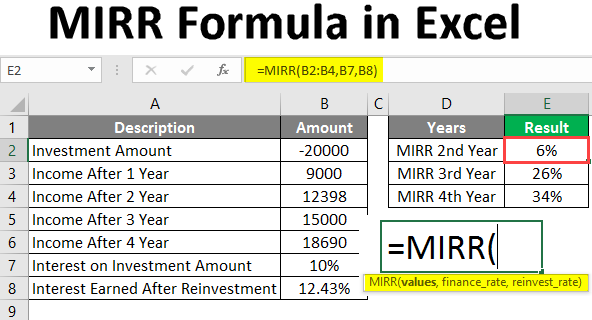

The MIRR formula used by firms and investors in capital budgeting is as follows. To calculate the reinvestment rate simply divide the total amount of cash flow that was reinvested back into the investment by the total amount of cash flow generated by the. ROIC stands for Return on Invested Capital and is a profitability or performance ratio that aims to measure the percentage return that a company earns on invested capital.

Cash reinvestment is a term used to describe the change in retained earnings over a certain period of time. Cash Reinvestment Ratio Increase in Fixed Assets Increase in Working Capital Net Income. How to Calculate the Modified Internal Rate of Return.

Add the Money invested. Here are a few major steps to use the Dividend Reinvestment Calculator. Since we set the reinvestment rate for MIRR to 0 we can make an extreme example to illustrate the point.

Calculating the MIRR considers three key variables. This is illustrated in Table 1. We can calculate the total future value of all cash flows from this bond as follows.

1 the future value of positive cash flows discounted at the. The life of the investment is 7 years so lets look at what each.

Reinvestment Rate Formula And Calculator

Why Net Depreciation From Capex For Computing Reinvestment Rate

How To Use Reinvestment Rate To Project Growth For Valuation

Level I Cfa Tutorial Fixed Income Reinvestment Assumption In Calculating Yield To Maturity Ytm Youtube

How To Use The Excel Mirr Function Exceljet

Calculating The Return On Incremental Capital Investments Saber Capital Management

Reinvestment Rate Formula And Calculator

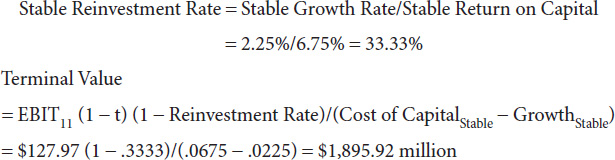

Reinvestment Rate Terminal Value Model Choice

Session 10 Growth Rates Terminal Value Model Choice Youtube

Myth 5 3 Growth Is Good More Growth Is Better By Aswath Damodaran Harvest

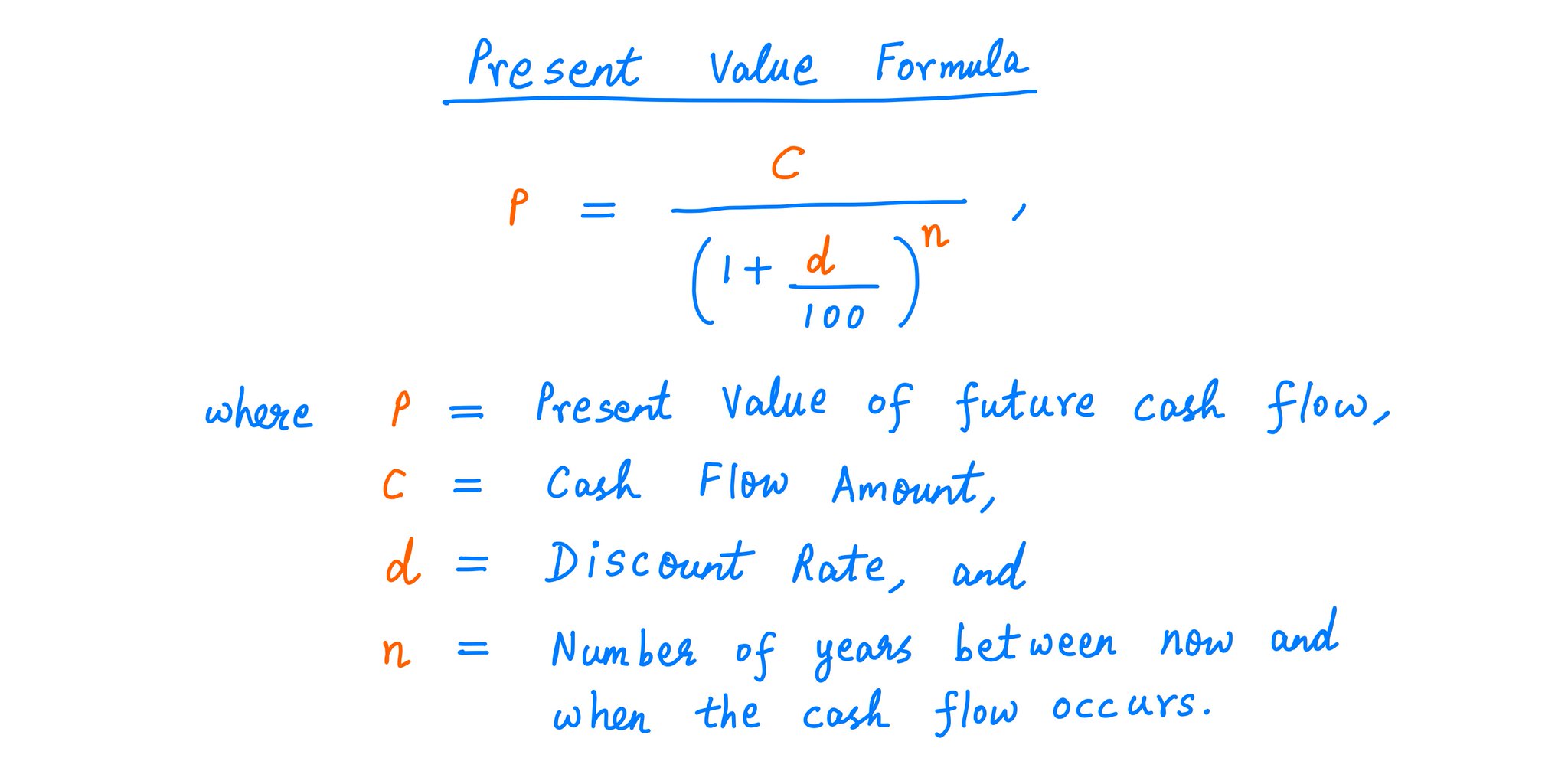

10 K Diver On Twitter 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes A Cash

The Light Side Of Valuation How To Value Growth Companies Informit

Corporate Valuation Free Cash Flow Approach Ppt Download

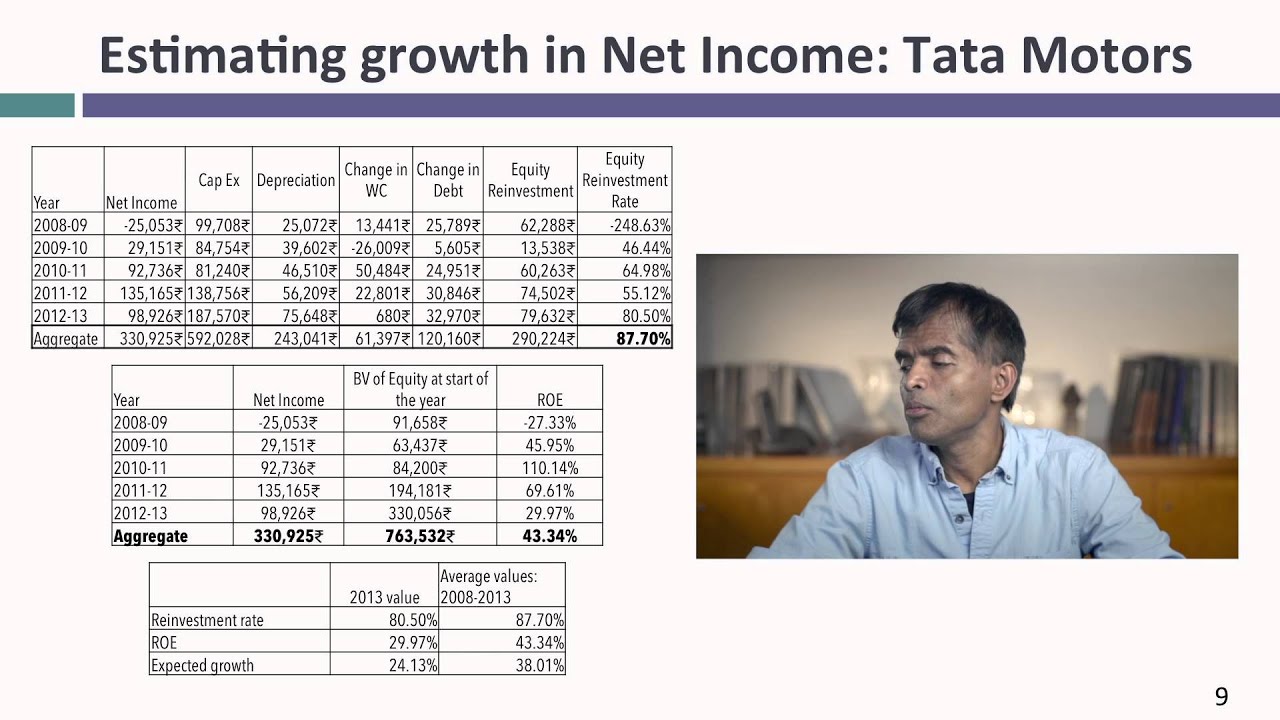

Session 31 Cash Flows Growth Rates Youtube

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

Mirr Formula In Excel How To Use Mirr Function With Examples

How To Use Reinvestment Rate To Project Growth For Valuation